Health Employer

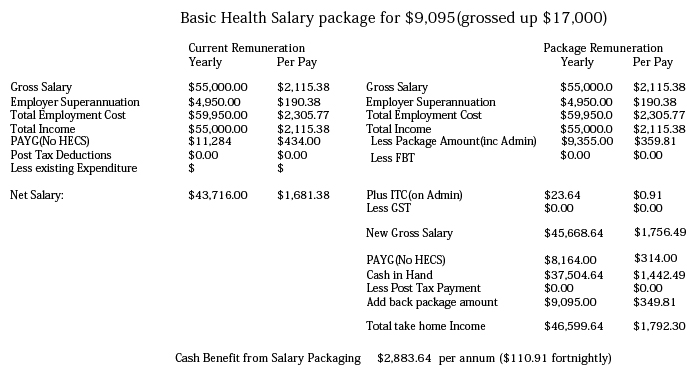

Public Hospitals and Public Benevolent Institutions/Charities (PBIs) are permitted to pay their staff a limited amount of fringe benefits without having to pay Fringe Benefits Tax (FBT). This means the employee effectively receives these benefits in tax free dollars. The following box explains exactly what dollar value the employees are entitled to. Effectively, if you work for a Public Hospital you can receive between $8,234 and $9,095 worth of benefits tax free and employees of PBIs can receive between $14,530 and $16,050 worth of benefits tax free.

Information, advice and services related to Salary Packaging is provided by Sheridan & Associates independently of Infocus Securities Australia Pty Ltd which is not responsible for provision of this Information, advice or services.